Learn about when people stop working in Canada. Find out the age for retirement in Canada, is it 65 or 67? Everything you need to know about the retirement age in Canada is right here in this article. It has got all the important details.

Retirement in Canada

Lots of people eagerly await retirement because it means they can stop working and start enjoying life. People usually save money and plan things like pension plans for their retirement. Knowing when to retire is an important part of this plan. It is the age when people leave their jobs to focus on themselves and their families.

In the past, there was a rule that said you had to retire at 65 in Canada. However, the law changed, and now, people in Canada can keep working for as long as they want.

Retirement Age in Canada

People usually think about retiring at 65, but it is not a must. If someone has enough money saved up, they can retire earlier. If you want to get Canada Pension Plan benefits, you can start getting them at 60. The amount you get depends on when you start and how much you have contributed.

The longer you wait to get the CPP Pension, the more money you will get. You can choose to start getting it anytime between 60 and 70. For Old Age Security, you can start at 65. To find out more about the age rules for different retirement benefits in Canada, you can check the official Canadian Government website.

Retirement Age in Canada 65 or 67

According to Statistics Canada, in 2022, the usual age when ladies stopped working was around 63.6 years on average and 63.8 years in the middle. For man, the regular retirement age in 2022 was about 65.5 years on average and 65.2 years in the middle.

For everyone, the average retirement age in 2022 was 64.6 years, and the middle age was 64.8 years. In 2021, both man and woman usually retired at 64.3 years on average and 64.5 years in the middle.

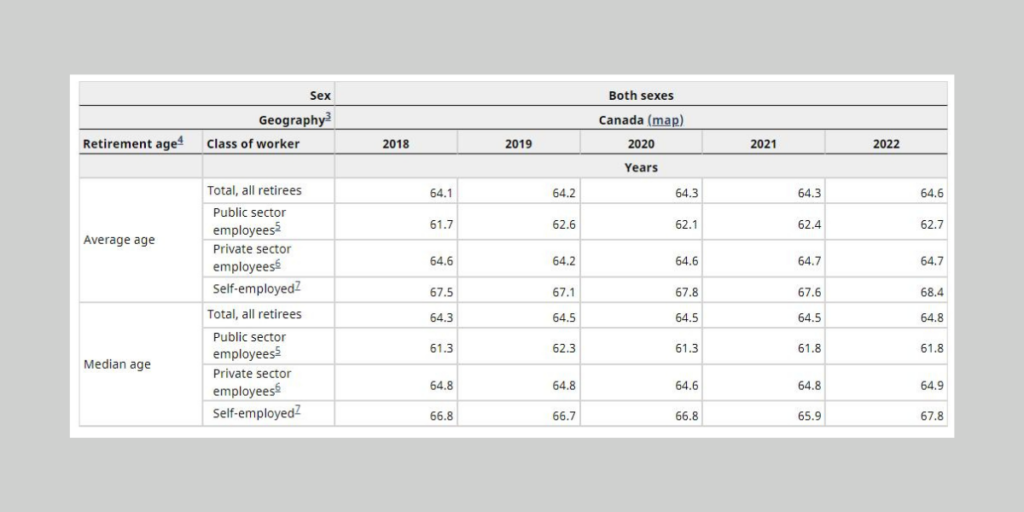

The average age when both men and women retire in Canada:

| Worker’s Class | 2020 | 2021 | 2022 |

| Total, all retirees | 64.3 years | 64.3 years | 64.6 years |

| Private sector | 64.6 years | 64.7 years | 64.7 years |

| Public sector | 62.1 years | 62.4 years | 62.7 years |

| Self-employed | 67.8 years | 67.6 years | 68.4 years |

See the middle age when both men and women typically retire in Canada:

| Worker’s Class | 2020 | 2021 | 2022 |

| Total, all retirees | 64.5 years | 64.5 years | 64.8 years |

| Private sector | 64.6 years | 64.8 years | 64.9 years |

| Public sector | 61.3 years | 61.8 years | In total, all retirees |

| Self-employed | 66.8 years | 65.9 years | 67.8 years |

Learn more about the usual and middle retirement ages in Canada by visiting the Statistics Canada website. They figure out these ages by looking at when people in government jobs, private jobs, and those who work for themselves stop working. These numbers can vary each year based on different things.

Everything About Retirement Age in Canada

Deciding when to retire early involves looking at different things like government pension benefits, savings for retirement, how you plan to retire, and if your workplace has a pension plan.

People need to think about all these things to figure out when to retire. If they want government benefits after they retire, they also need to make sure they qualify for them.

Other than just age, some benefit plans might have extra conditions. How someone wants to enjoy their retirement can also affect when they should retire. If they plan to buy something or go on a trip, they should make sure they have enough saved money and other benefits.

Moreover, people can go to the official Canadian Government website and use the Retirement Income Calculator. It helps figure out how much they might get from federal benefits like CPP and OAS. To use it, they just need to put in some important details, like their money situation, RRSP statements, contributions, and so on.

If someone has a great company pension, high pay, legacy, and a good retirement plan, they can choose to retire early, even before they turn 60. Most people usually retire between 60 and 70. Some people might even decide to retire later, like when they are 70 or older.

Important Links

People May Ask

Is the retirement age in Canada 65 or 67?

Old Age Security (OAS) begins at 65, not 67. There was a suggestion to raise the eligibility age to 67 starting April 1, 2023, but this change was stopped in 2016 by the liberal government. Canadians can start getting their OAS payment at 65.

Can you retire at 65 instead of 67?

Many people do not want to wait until their full retirement age. On average, people retire at around 64. If you were born after 1960 and retire at 65, you can expect to get 86.7% of your full retirement benefit.

Can a 65-year-old work in Canada?

Foreign workers need to be at least 18 for a Canadian work permit, and usually, there is no maximum age limit for Canadian work permits.

What happens when you turn 65 in Canada?

The Old Age Security (OAS) pension is a monthly payment you can get if you are 65 or older. Service Canada will often enrol you automatically, and they will let you know if they do.

I am a passionate technology and business enthusiast, constantly exploring the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.