See more information about Golden State Stimulus Checks 2023 Tracker here. This article has all the details about the Golden State Stimulus Checks 2023 Tracker, Payment Dates, Latest Update, and other important things. Have a look:

- Golden State Stimulus Checks 2023

- Overview of Golden State Stimulus Checks

- Checks Tracker of Golden State Stimulus in 2023

- Eligibility of Golden State Stimulus in 2023

- Latest Update of Golden State Stimulus Checks 2023

- Payment Dates of Golden State Stimulus Checks 2023

- People May Also Ask

- What is a Golden State stimulus payment?

- How do I get cash for my Golden State stimulus?

- Who gets the Golden State stimulus check in 2023?

Golden State Stimulus Checks 2023

California’s government brought in the Golden State Stimulus to assist folks with lower and middle incomes, especially those struggling because of the pandemic. To get it, you should have filed your 2020 tax returns. There are two kinds: GSS I and GSS II.

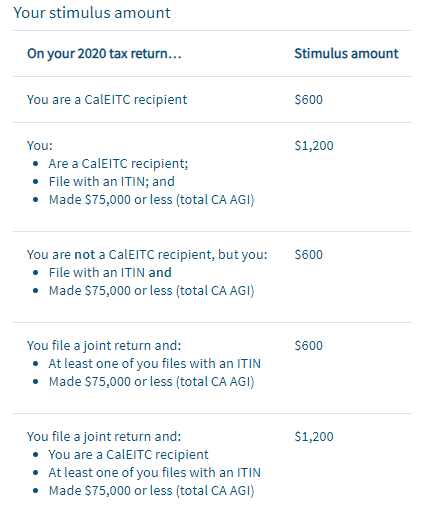

For GSS I, you might get 600 dollars or 1200 dollars, depending on if you qualify. GSS II could be 500 dollars, 600 dollars, or 1100 dollars, depending on your eligibility.

Overview of Golden State Stimulus Checks

| Name of the Article | Golden State Stimulus Checks |

| Body Administering | Franchise Tax Board, CA |

| State | California |

| Country | United States |

| Types | GSS I and GSS II |

| Stimulus Amount (GSS I) | 1200 dollars/600 dollars |

| Stimulus Amount (GSS II) | 1100 dollars/600 dollars/500 dollars |

| Visit the official Website | ftb.ca.gov |

Checks Tracker of Golden State Stimulus in 2023

To follow your Golden State Stimulus Checks, visit the official Franchise Tax Board website. The tracker there helps you see how much you will get and when. Before, this stimulus helped lots of people and families in California.

If you have done your taxes on time, your Golden State Stimulus Checks should be on the way. Other states in the US are also giving out stimulus checks. For more info, check the FTB California website.

Eligibility of Golden State Stimulus in 2023

FTB California gives all the rules for who can get the Golden State Stimulus in 2023. There are two types, each with its own rules. Most people qualify for GSS I, but GSS II has extra things you need to meet.

Look at the Golden State Stimulus I amount here:

Before to get GSS I, you had to do your 2020 taxes, live in California, and either get CalEITC or be an ITIN filer with an income $75,000 or less. For GSS II, you had to do your 2020 taxes by October 15, 2021, be a California resident, and have wages from $0 to $75,000 for 2020 and a CA AGI from $1 to $75,000 for 2020.

Important Links

Check the Golden State Stimulus II Amount:

FTB California will tell you about the new rules for Golden State Stimulus (GSS I and GSS II) on its official website. After they send out paper checks, it takes around 3 weeks for them to reach you. If you need help, you can call the helpline or send a letter to the address FTB California gives.

Latest Update of Golden State Stimulus Checks 2023

For the latest news about Golden State Stimulus 2023, go to the newsroom section. FTB California will probably tell you about new payment dates, amounts, rules, and steps soon.

There is a tool for GSS II where you can check how much your stimulus might be. Just answer a few questions, and it will give you an estimate. Even if you do not qualify for GSS II, you might still qualify for GSS I because the rules for both are not the same.

Payment Dates of Golden State Stimulus Checks 2023

The Franchise Tax Board, California, will tell you the dates when you will get your Golden State Stimulus checks in 2023. These dates show when the authorities will send out the stimulus money you are supposed to get. Remember, the amounts for Golden State Stimulus can be different based on different situations. After the checks are sent, it takes a few days for them to reach you.

They send out the payments based on the last three digits of your area PIN code. For instance, before, from October 6, 2021, to October 27, 2021, they sent GSS checks for the 000-044 pin code. You can find the full payment dates on the FTB California website using the last three digits of your area pin code.

People May Also Ask

What is a Golden State stimulus payment?

It is extra money for some folks who did their 2020 taxes. The aim is to help people with lower and middle incomes in California who are struggling because of COVID-19.

How do I get cash for my Golden State stimulus?

You have a few choices. You can go to a bank or credit union, but they might charge you. Walmart and check cashing stores can also do it, but they might have fees, too.

Who gets the Golden State stimulus check in 2023?

For GSS II, you had to do your 2020 taxes by October 15, 2021, be in California, and have wages from $0 to $75,000 for 2020 and a CA AGI from $1 to $75,000 for 2020.

I am a passionate technology and business enthusiast, constantly exploring the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.